개요

- Home

- 선박펀드

- 개요

선박투자회사제도

소개

선박투자회사제도는 투자자들로부터 모은 자금과 금융기관에서 차입한 자금으로 선박을 매입(건조) 하여 이를 선사에 빌려주고, 선사로부터 받은 대선료로 차입금을 상환하고 투자자에게 배당하는 금융기법

<‘02.5. 선박투자회사법 제정>도입배경

- 외환위기 이후 구조조정으로 국적선대가 급감하고, 선박금융에 대한 신용경색이 지속되어 해운 산업의 성장기반 붕괴 우려

- 또한, 자본집약적인 해운산업의 경쟁력을 제고하기 위해서 선박금융 역량확보가 절실

구조조정기금 캠코선박펀드

도입배경

2008년 글로벌 경기침체로 인한 해운시황 악화, 선박가격 하락 등 어려움을 겪는 해운업계의 구조개선을 지원하여 조선, 철강 등 전·후방 산업의 악화 도미노 현상 방지하고, 금융시장 신용경색에 따른 기업 및 금융기관의 잠재 부실화에 대한 선제적·종합적 대응을 위해 관련법 개정을 통해 구조조정기금을 설치하고, 구조조정기금 선박펀드를 조성

운영경과

- 해운업계의 구조개선을 지원하기 위해 「금융기관부실자산등의 효율적 처리 및 한국자산관리공사의 설립에 관한 법률」(이하 “캠코법”)을 개정하여 공적자금인 구조조정기금을 설치(‘09.05.13)하고, 그 관리·운용을 한국자산관리공사(캠코)가 수행

- 2009년 7월 구조조정기금을 활용한 첫 캠코선박펀드 출시 이후 총 33개의 선박투자회사를 설립하여 1조599억원의 선박금융(선가기준)을 조성하였음

- 캠코법상 구조조정기금의 운용기간 만료일(2014년 12월31일)에 맞춰 선박펀드 투자금액 전액을 구조조정기금에 상환함으로써 구조조정기금 선박펀드는 청산완료

캠코선박펀드

도입배경

2008년 글로벌 금융위기 및 2011년 유럽재정위기 이후 지속되는 경기 침체로 인해 해운산업의 수익성·건전성이 악화·심화되고 있고, 해운업의 유동성을 지원하던 구조조정기금 운영기간 종료(2014.12.31) 및 청산에 따라, 해운산업 경쟁력 약화를 차단하고 경쟁력을 강화하기 위해 선박은행(Tonnage Bank) 조성계획 발표(관계부처 합동, 2014.7.24.)

운영경과

- 정부의 선박은행 조성계획에 따라 캠코선박운용의 지분100%를 한국자산관리공사(캠코)가 인수(2015.3.2.)

- 캠코 자금을 선박에 투자하여 선박은행 기능을 수행하는 첫 캠코선박펀드를 2015년 5월 출시

Greetings from CEO

"By effective and stable management of ship funds, we will support the Korean shipping industry to contribute to raise the competence of shipping industry and revitalize shipping finance with our utmost effort."

Hello, my name is Jung Hwa Young, President and CEO of KAMCO Ship Investment Management. Thank you for visiting our website.

We are a ship investment management company operating 'KAMCO Ship Fund' established by Korea Asset Management Corporation(KAMCO). We were founded to manage 'Restructuring KAMCO Ship Fund', which was raised to reinforce the competitiveness of the domestic shipping industry following the global financial crisis in 2008. By 2020, we have contributed to the growth of the Korean shipping industry by managing 113 KAMCO Ship Funds in a systemic and efficient way.

Following 'Development policy of the tonnage bank(Jul 2014)', ‘Reinforcement plan of the competitiveness of the shipping industry(Oct 2016)’ and ‘5-year rebuilding plan of shipping industry(April 2018)’ announced by the Korean government, KAMCO invested around 1 trillion and 190 billion Korean won to ship delivery until 2020 and will expand the investment continuously. In line with this plan, we will actively support KAMCO to play a leading role in ‘revitalizing domestic shipping finance’ by supporting on ship delivery and thorough fund management.

Despite the gradual recovery of the shipping market, a crisis of the Korean shipping industry is still ongoing due to COVID-19 and, industrial paradigm and structural changes of the shipping industry caused by the 4th Industrial Revolution. Thus, we will support the Korean shipping industry to take a step forward with our utmost effort by proactive risk management of ship funds and provision of leading shipping market reports.

We sincerely ask for your attention and support.

Thank you,

OVERVIEW

KAMCO Ship Investment Management Company (KAMCO SIMC) is a company licensed by ‘Ministry of Oceans and Fisheries’ in accordance with Article 31 of 「Ship Investment Company Act」

The business outreaches to the purchase and charter of ships, financing from domestic and overseas financial institutions, issuance of bonds and stocks, management and disposal of purchased ships, and etc., on behalf of Ship Investment Company (SIC)

- Since the global financial crisis in 2008, KAMCO SIMC operated and cleared successfully 33 shipping funds built by Korea Asset Management Corporation (KAMCO) with the restructuring funds by March 2015.

- In July 2014, Korean government decided to develop ‘Tonnage Bank’ to support the local shipping industry based on the account from KAMCO. As a result, KAMCO SIMC was reestablished as a subsidiary of KAMCO in March 2015 to professionally and exclusively manage shipping funds provided by KAMCO.

| Corporate Name | KAMCO Ship Investment Management Co., Ltd. |

|---|---|

| Date of Establishment | 23rd June, 2009 |

| Paid-in Capital | KRW 7.0 billion |

| Shareholder | Korea Asset Management Corporation (100%) |

| CEO | Jung Hwa Young |

| Address | BIFC 53FL, 40, Munhyeongeumyung-ro, Nam-gu, Busan, 608-828, Korea TEL : +82 51 660 5500 FAX : +82 51 660 5532 |

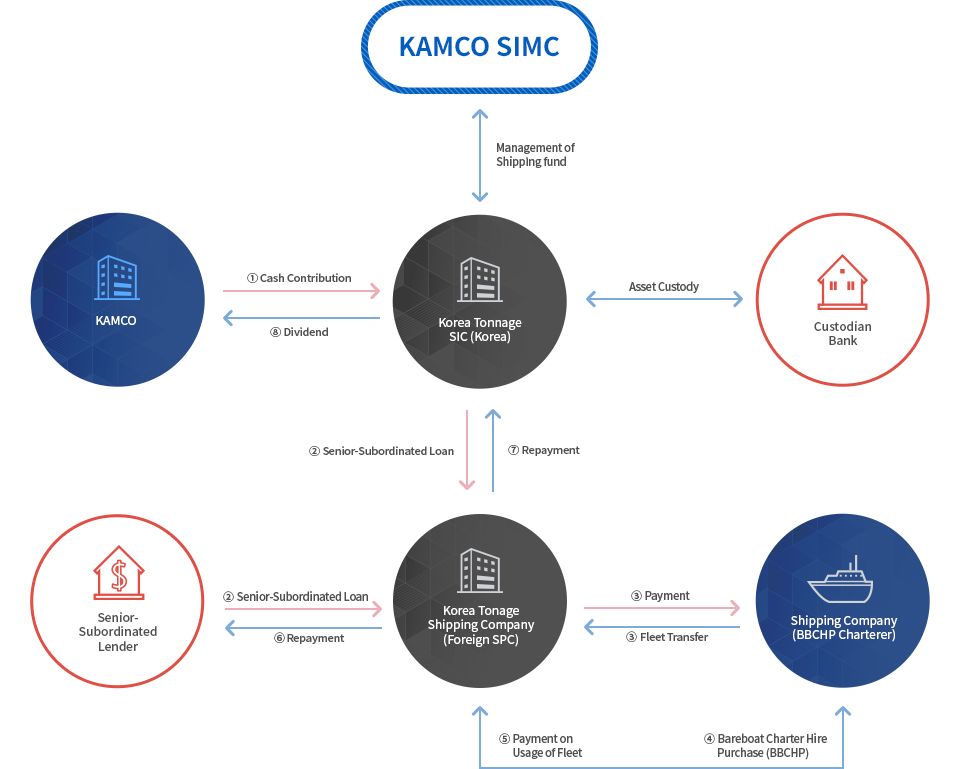

KAMCO Shipping Fund Structure